Introduction

In the world of technical analysis, traders and analysts often rely on chart patterns to predict potential market movements. One such pattern that has gained popularity in recent years is the Big Small Trend pattern. This pattern is characterized by a series of alternating large and small candlesticks, indicating a change in market sentiment and potential trend reversal. In this article, we will delve deeper into the Big Small Trend chart pattern, exploring its characteristics, significance, and how traders can effectively utilize it in their trading strategies.

Understanding the Big Small Trend Pattern

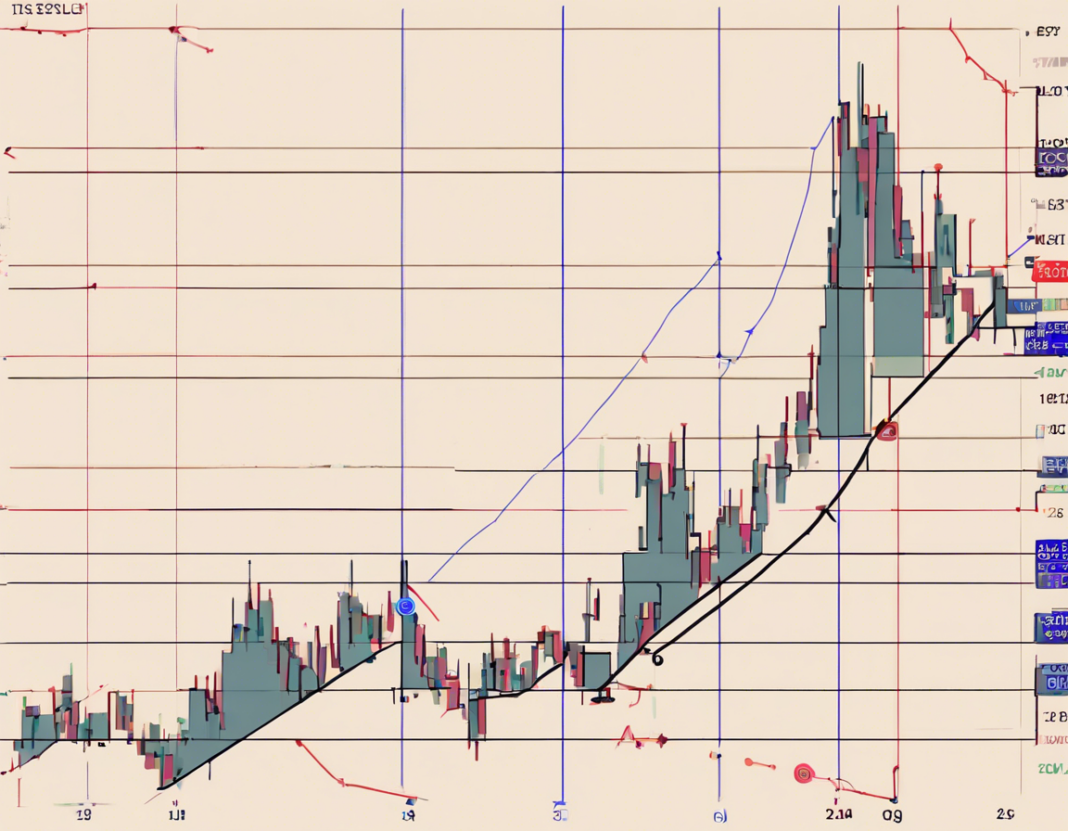

The Big Small Trend pattern is a relatively simple yet powerful pattern that can provide valuable insights into market dynamics. This pattern consists of a series of alternating large and small candlesticks, with each large candlestick followed by a smaller candlestick in the opposite direction. The pattern is characterized by a gradual increase or decrease in the size of the candlesticks, indicating a potential shift in market sentiment.

Significance of the Big Small Trend Pattern

One of the key advantages of the Big Small Trend pattern is its ability to signal potential trend reversals. The alternating large and small candlesticks suggest that the current trend may be losing momentum, and a reversal could be imminent. Traders can use this pattern to anticipate changes in market direction and adjust their trading strategies accordingly.

Identifying the Big Small Trend Pattern

To effectively identify the Big Small Trend pattern, traders should look for a series of at least three alternating large and small candlesticks. The pattern is most reliable when it occurs after a prolonged trend, indicating a potential exhaustion of the prevailing trend. Traders can use technical indicators such as moving averages or trendlines to confirm the validity of the pattern and make informed trading decisions.

Trading Strategies with the Big Small Trend Pattern

There are several trading strategies that traders can employ when trading the Big Small Trend pattern. One common strategy is to wait for the pattern to complete and enter a trade in the direction of the reversal. Traders can set stop-loss orders to manage risk and target potential profit levels based on the size of the pattern.

Additionally, traders can use the Big Small Trend pattern in conjunction with other technical analysis tools to increase the probability of successful trades. By combining the pattern with indicators such as RSI or MACD, traders can confirm the validity of the signal and make more accurate predictions about market movements.

Conclusion

In conclusion, the Big Small Trend pattern is a valuable tool for traders looking to identify potential trend reversals and make informed trading decisions. By understanding the characteristics and significance of this pattern, traders can improve their technical analysis skills and enhance their overall trading performance. Incorporating the Big Small Trend pattern into a comprehensive trading strategy can help traders navigate volatile market conditions and capitalize on profitable trading opportunities.

Frequently Asked Questions (FAQs)

- What time frames are best suited for trading the Big Small Trend pattern?

-

The Big Small Trend pattern can be applied to various time frames, but it is most effective on higher time frames such as the daily or weekly charts.

-

How can I differentiate between a true Big Small Trend pattern and random fluctuations in price?

-

Look for a series of at least three alternating large and small candlesticks following a prolonged trend to confirm the validity of the pattern.

-

Is the Big Small Trend pattern suitable for all financial markets?

-

Yes, the pattern can be applied to various financial markets, including stocks, forex, commodities, and cryptocurrencies.

-

Can the Big Small Trend pattern be used in isolation for trading decisions?

-

While the pattern can provide valuable insights, it is recommended to use it in conjunction with other technical analysis tools for more comprehensive analysis.

-

How can I backtest the effectiveness of the Big Small Trend pattern?

-

Traders can backtest the pattern using historical price data and analyzing its performance in various market conditions to determine its reliability.

-

Are there any specific entry and exit rules when trading the Big Small Trend pattern?

-

Entry and exit rules can vary based on individual trading preferences, but common practices include entering after the pattern completion and setting stop-loss orders below the recent swing low or high.

-

Does the Big Small Trend pattern work better in trending or ranging markets?

-

The pattern is more effective in trending markets where it can signal potential trend reversals, but it can also be applied in ranging markets to identify consolidation phases.

-

Can automated trading systems be used to detect Big Small Trend patterns?

-

Yes, traders can develop automated trading systems using specific criteria to identify and trade the Big Small Trend pattern based on predefined rules.

-

Is it necessary to wait for confirmation from other technical indicators before entering a trade based on the Big Small Trend pattern?

-

While confirmation from other indicators can increase the reliability of the signal, some traders prefer to enter trades based solely on the pattern’s formation and price action.

-

What risk management techniques should traders implement when trading the Big Small Trend pattern?

- Traders should establish risk-reward ratios, set stop-loss orders to limit losses, and avoid overleveraging when trading the Big Small Trend pattern to manage risk effectively.